- Registration for ECO

There are 2 types of ECO specified under CGST Act:

- ECO supplying notified services or both as prescribed u/s 9(5)

- Other ECO, i.e. ECO supplying services other than those specified in point 1 above.

- ECO supplying Services notified u/s 9(5)

Where the ECO supplies the notified services, such ECO shall be liable for mandatory registration under section 24(iv) of the CGST Act. In such a case, ECO shall be responsible to pay the taxes.

Four (4) services are notified u/s 9(5) on which tax shall be paid by the ECO, details of which are appended as follows:

| S. No. | Notification No. | Date of Applicability | Nature of Services | Example |

| 1 | NN – 17/2017 – CT(R) | 01 July, 2017 | Transportation of Passengers by radio-taxi, motor cab, maxi-cab, motor cycle, omnibus, or any other motor vehicle | Ola, Uber |

| 2 | Accommodation in hotels inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes, except where the person supplying such service through ECO is liable for registration u/s 22(1) of CGST Act. | Oyo, MMT | ||

| 3 | NN – 23/2017 – CT(R) | 01 July, 2017 | Services by way of house-keeping, such as plumbing, carpentering etc, except where the person supplying such service through ECO is liable for registration u/s 22(1) of CGST Act. | Urban Clap |

| 4 | NN – 17/2021 – CT(R) | 01 January, 2022 | Supply of restaurant service other than the services supplied by restaurant, eating joints etc. located at specified premises Specified premises means premises providing hotel accommodation service having declared tariff of any unit of accommodation above Rs. 7,500 per unit per day or equivalent. | Swiggy, Zomato |

- Other ECO – i.e. ECO supplying Services other than services notified u/s 9(5)

Such ECO are required for GST Registration u/s 24(x) of CGST Act.

Examples of Other ECO could be Amazon, Meesho, Myntra etc.

- Registration of Suppliers on ECO

Similar to ECO, we need to bifurcate whether the supplier is on ECO who is supplying services as specified u/s 9(5) or through other ECO.

- For suppliers who is on ECO supplying services as specified u/s 9(5):

NN-65/2017 dated 15 Nov, 2017 states that person making supplies of services (other than notified services) through an ECO who is required to collect tax u/s 52 is exempted from taking GST Registration provided:

- His aggregate turnover does not exceed Rs. 10 lakhs in a FY if he has Principal Place of Business in Sikkim, Himachal Pradesh, Arunachal Pradesh, Nagaland, Tripura, Meghalaya, Uttarakhand, Manipur, Mizoram, and Assam.

- His aggregate turnover does not exceed Rs. 20 lakhs in a FY for other States

Where the supplier is supplying notified services, the GST Registration shall be made according to the turnover limits as specified u/s 22(1)

- For suppliers who are on other ECO:

GST Registration is mandatory u/s 24(ix) of CGST Act.

However, NN-34/2023 was notified stating that the suppliers whose turnover does not exceed the limit specified u/s 22(1), are not required for GST Registration subject to certain conditions as specified in the notification.

In such case, such suppliers are required to get an Enrollment ID from the GST Portal in order to continue the sales on the ECO portal.

Other Suppliers are mandatorily required to get them registered under GST vide section 24(ix) of the CGST Act.

NN – 34/2023 dated 31 July, 2023 – w.e.f 01.10.2023

Suppliers supplying through E-Commerce operator (not supplying services notified u/s 9(5) of CGST Act, 2017) are not required to take mandatory registration u/s 24(ix), if following conditions are satisfied:

- The turnover of the supplier should not exceed the limit specified u/s 22(1)

- The Supplier shall not make any inter-state supply

- Such persons shall not make supply of goods through electronic commerce operator in more than one State or Union territory

- Such persons shall be required to have a Permanent Account Number issued under the Income Tax Act, 1961 (43 of 1961)

- Such persons shall, before making any supply of goods through electronic commerce operator, declare on the common portal their Permanent Account Number issued under the Income Tax Act, 1961 (43 of 1961), address of their place of business and the State or Union territory in which such persons seek to make such supply, which shall be subjected to validation on the common portal

- Such persons have been granted an enrolment number on the common portal on successful validation of the Permanent Account Number declared as per clause (iv)

- Such persons shall not be granted more than one enrolment number in a State or Union territory

- No supply of goods shall be made by such persons through electronic commerce operator unless such persons have been granted an enrolment number on the common portal

- Where such persons are subsequently granted registration under section 25 of the said Act, the enrolment number shall cease to be valid from the effective date of registration

NN – 37/2023 dated 04 August, 2023 – w.e.f 01.10.2023

Procedure for E-Commerce Operators collecting tax u/s/52:

- The ECO shall allow the supply of goods through it by the said person only if enrolment number has been allotted on the common portal to the said person

- The ECO shall not allow any inter-State supply of goods through it by the said person

- The ECO shall not collect tax at source under sub-section (1) of section 52 in respect of supply of goods made through it by the said person

- The ECO shall furnish the details of supplies of goods made through it by the said person in the statement in FORM GSTR-8 electronically on the common portal.

Where multiple electronic commerce operators are involved in a single supply of goods through electronic commerce operator platform, “the electronic commerce operator” shall mean the electronic commerce operator who finally releases the payment to the said person for the said supply made by the said person through him.

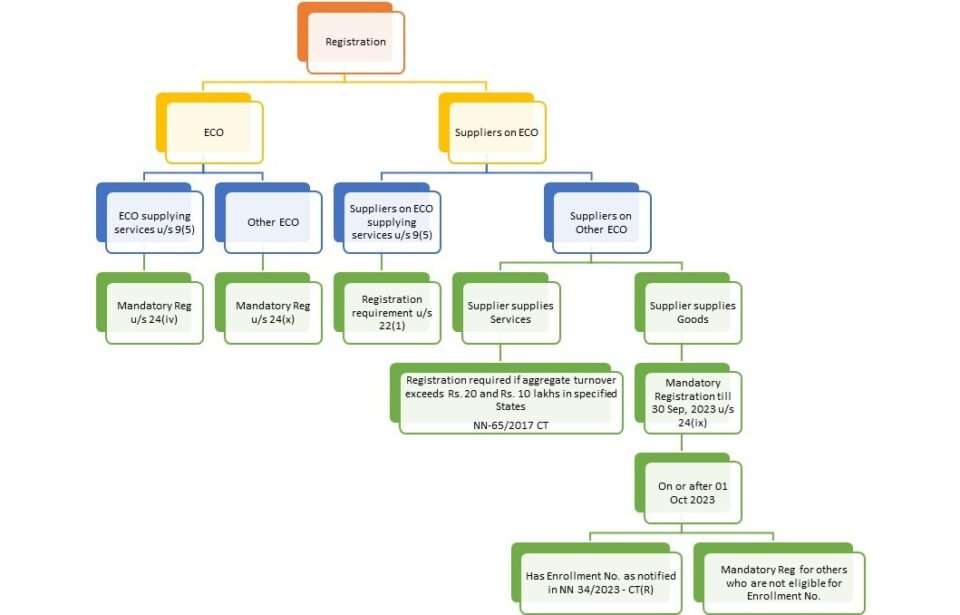

A summary of the above is represented through a Flow chart for quick understanding:

Section 24. Compulsory registration in certain cases.-

Notwithstanding anything contained in sub-section (1) of section 22 , the following categories of persons shall be required to be registered under this Act,-

- persons making any inter-State taxable supply;

- casual taxable persons making taxable supply;

- persons who are required to pay tax under reverse charge;

- person who are required to pay tax under sub-section (5) of section 9 ;

- non-resident taxable persons making taxable supply;

- persons who are required to deduct tax under section 51 , whether or not separately registered under this Act;

- persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

- Input Service Distributor, whether or not separately registered under this Act;

- persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9 , through such electronic commerce operator who is required to collect tax at source under section 52 ;

- every electronic commerce operator 1 [who is required to collect tax at source under section 52

- every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person; and

- such other person or class of persons as may be notified by the Government on the recommendations of the Council.