In February 2024, the Finance Act’ 2023 introduced Section 43B(h) to the Income Tax Act, 1961. The law states that any payment due to micro or small enterprise shall be allowed as deduction under Income Tax only if the payment is made to such enterprise within the time limit specified under MSMED Act, 2006. So what is MSME, what are the benefits available to MSME suppliers and what are the shield available to the buyers.

This amendment takes effect from 1st April, 2024 and will be applicable in computation of income in relation to Assessment Year 2024-25 and subsequent years.

Extract of Section 43B(h) of Income Tax Act, 1961, is appended as follows:

“43B. Notwithstanding anything contained in any other provision of this Act, a deduction otherwise allowable under this Act in respect of—

(a) ……..

(b) ……..

…….

(h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006), shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him.”

As per the Section mentioned above, for computing income for a Financial Year, where any buyer has purchased from MSME registered supplier, the corresponding deduction under Income Tax Act shall be allowed to the buyer only when the payment is made by him to the supplier. Such deduction shall be allowed only in the year in which such payment is made.

Unlike 43B(a) to 43B(g), if payment is made to MSME registered supplier after the end of Financial Year but before filing the return on due date, the deduction is still disallowed and shall be allowed only in the year in which payment is made by the buyer.

With the advent of Section 43B(h), with the Financial Year approaching its end and considering more than 3.64 crores units registered as MSME in India – significant transactions took place at the year-end to settle the dues owed to MSME Suppliers. Thus, enabling the taxpayers to avail the deduction of the purchases made from the MSME.

Section 43B(h) is applicable to only those assesses whose income is determined under profits and gains from business and profession, i.e. from Section 28 to Section 44AD. Thus, it shall not be applicable on society, trust, charitable institutions whose income is determined under Section 11 and 12 of the Income Tax Act, 1961.

Whether disallowance under section 43B(h) will be attracted if any supplier is registered under the MSMED Act?

Meaning of Supplier as per Sec 2(n) of MSMED Act means a micro or small enterprise, which has filed a memorandum with the authority referred to in sub-section (1) of section 8. Therefore only those micro and small enterprises who have obtained UDYAM registration shall be eligible to obtain benefit of section 43B(h).

Hence, it is crucial to understand the meaning of micro or small enterprise, time limit for payment to MSME Suppliers, the shield provided to suppliers registered under MSME and what steps a buyer or taxpayer shall undertake to protect themselves from any loss.

Numerous enterprises are now incorporating their UDYAM registration number on the invoices. Through such UDYAM registration number, one could verify whether the enterprise is registered as a “Micro”, “Small” or “Medium” enterprise.

It is also important to note that when a supplier includes their UDYAM registration number on the invoice/ letterhead, it is deemed that they have communicated their MSME status to the buyers. [Ref OM No.2(18)/2007-MSME(pol), dt. 26-08-2008]

The MSME certificate could be downloaded and verified through the following link:

https://udyamregistration.gov.in/udyam_verify.aspx

Meaning and Classification of Enterprise – MSME Definition

Section 2(e) of MSMED Act, 2006, defines “Enterprise” as:

“An industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951or engaged in providing or rendering of any service or services.”

According to the above definition, the enterprise only includes such businesses and establishments which are:

- engaged in the manufacture or production of goods

- engaged in providing or rendering of any services

Yet another communication viz. Office Memorandum dated 2nd July, 2021 of the Government of India, Ministry of MSME is to be noted. It clarifies that based on representations it was decided to include retail and wholesale traders registered on the Udyam Registration Portal under the definition of “Enterprise”. However, benefits to retail and wholesale trade MSMEs are to be restricted to priority sector lending only. Thus, units engaged in trading though registered as MSME does not form part of the definition of “enterprise” and Section 43B(h) would not be applicable to them.

Classification of Enterprise

| Types | Micro | Small | Medium |

| Investment in Plant and Machinery or equipment & Turnover | < Rs. 1 crore & < Rs. 5 crore | < Rs. 10 crore & < Rs. 50 crore | < Rs. 50 crore & < Rs. 250 crore |

If an enterprise crosses any of the limits specified in its present category either by way of investment in plant & machinery / equipment or turnover, it would be automatically placed in the next higher category. However, for downgrading the enterprise, both the criteria should be satisfied and fall below the limit from the existing level.

Calculation of Investment in Plant & Machinery or Equipment

For the purpose of calculating the investment in plant & machinery, the cost of pollution control, research and development, industrial safety equipment or notified items shall be excluded.

Calculation of Turnover

(1) Exports of goods or services or both, shall be excluded while calculating the turnover of any enterprise whether micro, small or medium, for the purposes of classification.

(2) Information as regards turnover and exports turnover for an enterprise shall be linked to the Income Tax Act or the Central Goods and Services Act (CGST Act) and the GSTIN

| Summary of applicability of Section 43B(h): Suppliers are registered under MSME; and Are engaged in the business of providing services or manufactured goods (not applicable on traders); and Suppliers are registered with MSME under the “Micro” or “Small” enterprise category; and The payment is not made to the suppliers as per Section 15 of MSMED Act, 2006 |

On the basis of investment in Plant & Machinery and Turnover, the enterprise is categorized into Micro, Small or Medium enterprises. Important to highlight that Section 43B(h) restricts the itself to payment made to “micro and small enterprises” only. Thus, no limitation arises where payment is not made to Medium Enterprises in the manner prescribed under Section 15 of MSMED Act, 2006.

Liability of buyer to make payment within prescribed Time Limit

– Section 15 of MSMED Act, 2006

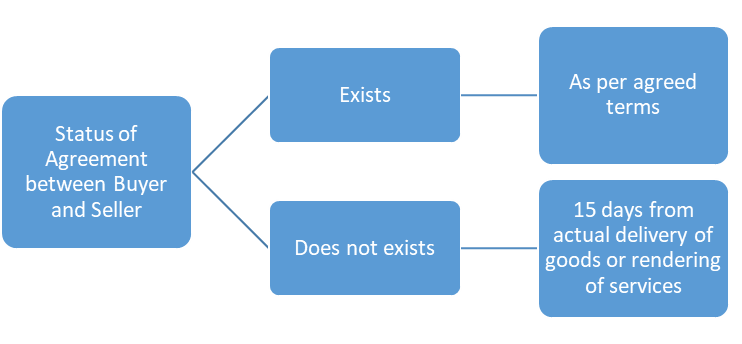

Section 15 of MSMED Act, 2006 mandates payments to the MSME registered supplier within the time as per the written agreement, which cannot be more than 45 days. If there is no such written agreement, the section mandates that the payment shall be made within 15 days from day of acceptance or day of deemed acceptance.

| Provided that in no case the period agreed shall exceed 45 days from the date of acceptance or date of deemed acceptance. |

Day of Acceptance or Day of Deemed Acceptance (Section 2(b) of MSMED Act, 2006)

Day of Acceptance means the day of:

- Actual delivery of goods or rendering of services or

- If objection is made by buyer in writing regarding acceptance of goods or services within 15 days from the day of the delivery of goods or rendering of services – the day on which such objection is removed by the supplier.

Day of Deemed Acceptance means the day of:

- Actual delivery of goods or rendering of services, if no objection is made by buyer in writing regarding acceptance of goods or services within 15 days from the day of the delivery of goods or rendering of services.

| Provided that in no case the period agreed shall exceed 45 days from the date of acceptance or date of deemed acceptance. |

Penal Interest if payment is NOT made to supplier within prescribed Time Limit

If buyer fails to make payment to the supplier within the time limits discussed above, the buyer shall be liable to pay compound interest with monthly rest to the supplier on that amount from the next day of:

- The end of agreed period – in case where agreement exists or

- The end of 15 days from day of acceptance or day of deemed acceptance – in case where agreement does not exists.

The interest rate shall be three times of the bank rate notified by RBI.

If, the current repo rate of bank is 6.5%, the interest rate shall be three time of 6.5%, i.e. 19.5%.

Computation of Interest amount – Compound Interest with monthly rest

Illustration: PQR Private Limited purchased raw material of Rs. 1,00,000 from Anshul Enterprises (registered with MSME) on 6th March, 2024, and the delivery was made on same day. The payment terms were agreed on 50 days from the date of actual delivery of goods. However, PQR Private Limited paid on 6th May, 2024. Comment on the following:

- The amount of interest to be charged by Anshul Enterprises

- What if there was no agreement between PQR Private Limited and Anshul Enterprises

- What if the payment was made on 30th March, 2024

The amount of interest to be charged by Anshul Enterprises

The days of agreement between the parties is 50 days which exceeds the basic limit of 45 days. Thus, PQR Private Limited shall pay within 45 days from 6th March, 2024, which is 20th April, 2024.

Since, the payment is made on 6th May, 2024, i.e. after expiry of 45 days, PQR Private Limited shall be liable for penal interest from 21st April, 2024 to 6th May, 2024.

| Start Date | End Date | No of days | Amount | Rate of interest | Amount of Interest |

| 21st April, 2024 | 30th April, 2024 | 10 | 1,00,000 | 19.5% p.a. | 534.25 |

| 1st May, 2024 | 6th May, 2024 | 6 | 1,00,534.25 | 19.5% p.a. | 322.25 |

| Total Interest | 856.50 |

What if there was no agreement between PQR Private Limited and Anshul Enterprises

PQR Private Limited would not be able to enjoy the credit period of 50 days, restricted to 45 days as per MSMED Act, 2006. PQR Private Limited shall be liable to pay within 15 days from the date of delivery, i.e. 21st March, 2024. Now the interest shall be liable to be paid from 22nd March, 2024 to 6th May, 2024.

| Start Date | End Date | No of days | Amount | Rate of interest | Amount of Interest |

| 22nd March, 2024 | 31st March, 2024 | 10 | 1,00,000 | 19.5% p.a. | 534.25 |

| 1st April, 2024 | 30th April, 2024 | 30 | 1,00,534.25 | 19.5% p.a. | 1,611.30 |

| 1st May, 2024 | 6th May, 2024 | 6 | 1,02,145.60 | 19.5% p.a. | 327.42 |

| Total Interest | 2,472.97 |

| It is crucial to note that where agreement does not exists, and the payment is delayed by the buyer, the interest amount has grown from Rs. 856 to Rs. 2,472. |

What if the payment was made on 30th March, 2024

The days of agreement between the parties is 50 days which exceeds the basic limit of 45 days. Thus, PQR Private Limited shall pay within 45 days from 6th March, 2024, which is 20th April, 2024.

Since, the payment was made on 30th March, 2024, i.e. before 20th April, 2024, no interest liability shall arise.

MSME Samadhan available to MSME Suppliers

It is a portal available to suppliers registered under MSME to raise their complaints regarding non-receipt of payment from their buyers. MSME Samadhan acts as a dispute resolution portal between the buyer and supplier.

Additional points for buyer

Section 22 of MSMED Act, 2006 – Requirement to specify unpaid amount with interest in the annual statement of accounts

Where any buyer is required to get his annual accounts audited under any law for the time being in force, such buyer shall furnish the following additional information in his annual statement of accounts, namely:—

- the principal amount and the interest due thereon (to be shown separately) remaining unpaid to any supplier as at the end of each accounting year;

- the amount of interest paid by the buyer in terms of section 16, along with the amounts of the payment made to the supplier beyond the appointed day during each accounting year;

- the amount of interest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under this Act;

- the amount of interest accrued and remaining unpaid at the end of each accounting year; and

- the amount of further interest remaining due and payable even in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise, for the purpose of disallowance as a deductible expenditure under section 23.

Section 23 of MSMED Act, 2006 – Interest not to be allowed as deduction from income

The amount of interest payable or paid by any buyer under MSMED Act, 2006, shall not be allowed as deduction for the purposes of computation of income under the Income-tax Act, 1961.

Filing of Form MSME-1

Where the buyer is registered under ROC, i.e. a Company or an LLP, he is required to furnish the details of pending payments of MSME supplier on bi-annually basis, i.e. April to September and October to March.

Followings details are reported under the said form:

- CIN and PAN of the company

- Name, address and e-mail of the company

- Name and PAN of the suppliers

- Outstanding amount due against the supply of goods or services

- Date from which the amount is due

- Reason for delay in payment of the amount due

Action to be taken by Tax Auditors in case the Non Compliance of section 43B(h)

With effect from Financial Year 2023-24, where payment is due to the “Micro” or “Small” enterprises as on 31.03.2024, in terms with Section 15 of MSMED Act, 2006, such facts shall be disclosed by the Tax Auditor in the his income tax Form 3CD – Clause 22. It may lead to disallowance of the expenditure and adding back of the said amount in the income of the assesse. As a result, exposure to penal provisions of income tax act would be attracted on the assessee.

The assesse shall be allowed the deduction of the said expenditure only in the year in which actual payment is made by him to the supplier.

Effect of Section 43B(h) on computation of Income:

Suppose, the income from business and profession is Rs. 5 lakhs, but the disallowance due non-payment under Section 43B(h) is Rs. 15,00,000.

| Particulars | Section 43B(h) applicable | Section 43B(h) not applicable | Effect of Sec 43B(h) |

| Income from PGBP | 5,00,000 | 5,00,000 | |

| Add: Disallowance of expenditure u/s 43B(h) | 15,00,000 | – | |

| Gross Total Income | 20,00,000 | 5,00,000 | |

| Tax @ 30% | 6,00,000 | 1,50,000 | 4,50,000 |

| Cess @ 4% | 24,000 | 6,000 | 18,000 |

| Tax + Cess | 6,24,000 | 1,56,000 | 4,68,000 |

It is clear from the above table, that the cash outflow due to disallowance of expenditure under Section 43(B)(h) has been increased from Rs. 1.56 lakhs to Rs. 6.24 lakhs. It could put a severe question on the survival of small businesses.

Shield of Buyer

1. Ask for MSME Registration Certificate from the supplier and identify the category under which he is registered as MSME, i.e. micro, small or medium enterprise. Since, Section 43B(h) is applicable on Micro and Small Enterprises only and not on Medium Enterprises.

2. Always have an agreement with the suppliers registered under MSME for 2 main reasons:

a. To avoid payment within 15 days from delivery of goods or services

b. To save themselves from the interest charged by supplier after 15 days of non-payment to avoid any financial loss

3. The buyer, in any case, shall pay the Supplier registered under MSME within 45 days from the date of acceptance or date of deemed acceptance. It shall save the buyer from unwanted cash outflows in the nature of interest or Income Tax.